Navigating the Wholesale Market: Understanding the Importance of Tax Identification Numbers

Related Articles: Navigating the Wholesale Market: Understanding the Importance of Tax Identification Numbers

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Wholesale Market: Understanding the Importance of Tax Identification Numbers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Wholesale Market: Understanding the Importance of Tax Identification Numbers

- 2 Introduction

- 3 Navigating the Wholesale Market: Understanding the Importance of Tax Identification Numbers

- 3.1 The Foundation of Wholesale Transactions: Tax Identification Numbers

- 3.2 Benefits of Utilizing a Tax Identification Number for Wholesale Purchases

- 3.3 Understanding the Different Types of Tax Identification Numbers

- 3.4 Obtaining a Tax Identification Number

- 3.5 FAQs Regarding Tax Identification Numbers and Wholesale Purchases

- 3.6 Tips for Utilizing a Tax Identification Number for Wholesale Purchases

- 3.7 Conclusion: The Importance of Tax Identification Numbers in Wholesale Operations

- 4 Closure

Navigating the Wholesale Market: Understanding the Importance of Tax Identification Numbers

The world of wholesale offers a unique opportunity for businesses and individuals to access bulk quantities of goods at discounted rates. However, navigating this market effectively necessitates a clear understanding of its regulatory landscape, particularly the role of tax identification numbers. This article delves into the intricacies of tax identification numbers (TINs) in the context of wholesale purchasing, outlining their significance, benefits, and nuances.

The Foundation of Wholesale Transactions: Tax Identification Numbers

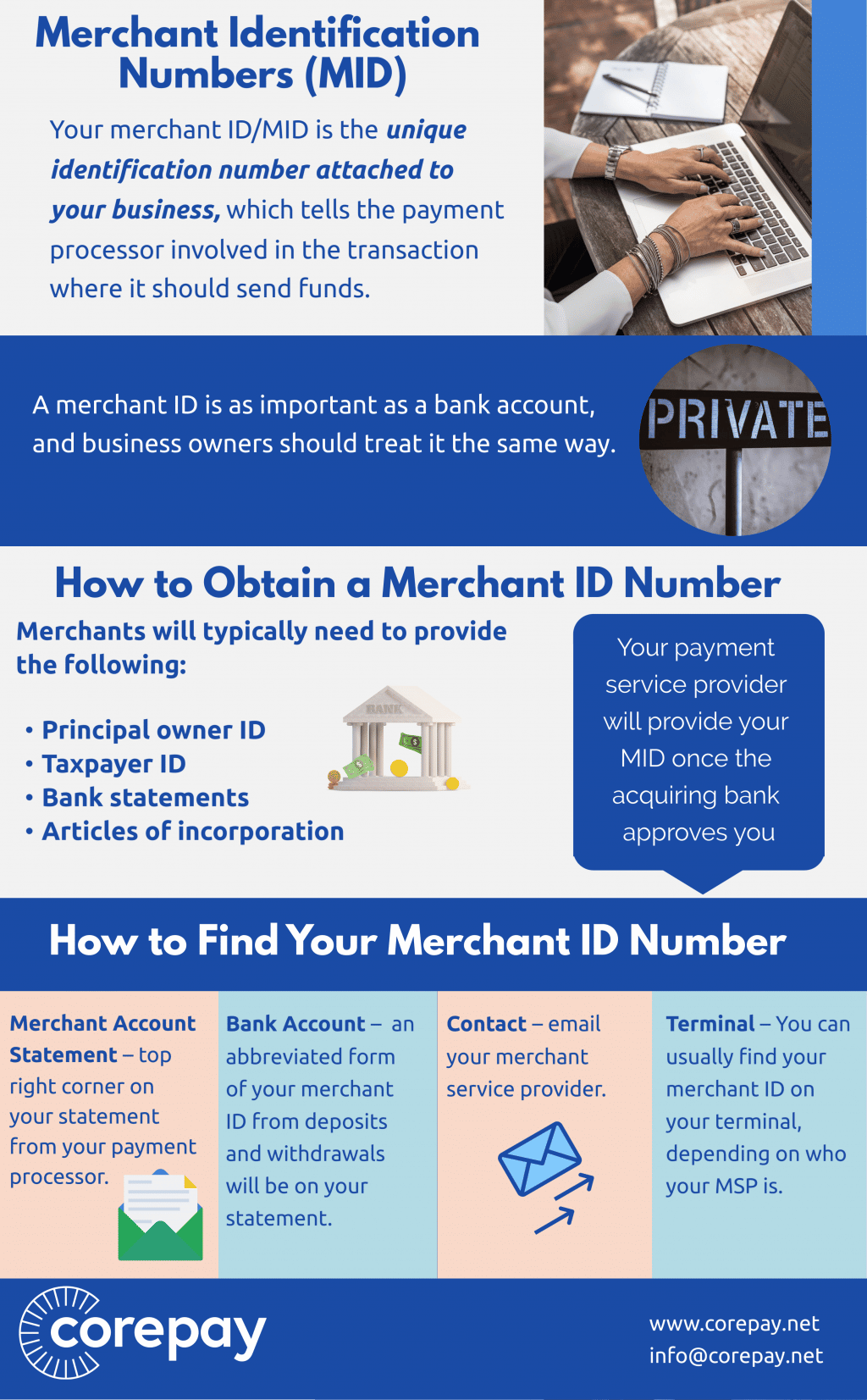

A tax identification number, often referred to as a tax ID, serves as a unique identifier for businesses and individuals for tax purposes. In the United States, the most common TIN is the Employer Identification Number (EIN), issued by the Internal Revenue Service (IRS). The importance of a TIN extends beyond tax compliance; it acts as a crucial element in establishing legitimacy and facilitating transactions within the wholesale market.

Benefits of Utilizing a Tax Identification Number for Wholesale Purchases

Obtaining a TIN and using it when engaging in wholesale transactions offers numerous advantages:

1. Establishing Legitimacy and Trust: A TIN serves as a verifiable identifier, assuring suppliers that they are dealing with a legitimate entity. This fosters trust and confidence, crucial for building long-term relationships within the wholesale market.

2. Streamlining Transactions and Procurement: The use of a TIN simplifies the purchase process, facilitating smooth transactions with suppliers. Many wholesalers require a TIN for account setup and order processing, ensuring efficient order fulfillment and payment management.

3. Accessing Wholesale Discounts and Privileges: Wholesalers often offer exclusive discounts and benefits to businesses that possess a TIN. These benefits can significantly reduce procurement costs and enhance profit margins.

4. Ensuring Compliance with Tax Regulations: A TIN is essential for fulfilling tax obligations related to wholesale purchases. This includes reporting income and expenses, accurately calculating tax liabilities, and complying with relevant regulations.

5. Facilitating Financial Transactions: A TIN is often required for opening business bank accounts, obtaining credit lines, and securing loans. These financial tools are crucial for managing cash flow and financing wholesale operations.

Understanding the Different Types of Tax Identification Numbers

While the EIN is the primary TIN in the United States, other types of tax identification numbers exist, each serving specific purposes:

- Social Security Number (SSN): Primarily used for individual taxpayers, an SSN can be used as a TIN for small businesses operating as sole proprietorships or partnerships.

- Individual Taxpayer Identification Number (ITIN): Issued to non-resident aliens who have a tax filing obligation in the United States.

- Taxpayer Identification Number (TIN): A general term encompassing various forms of tax identification numbers, including EINs, SSNs, and ITINs.

Obtaining a Tax Identification Number

The process of obtaining a TIN varies depending on the type of number required. In the case of an EIN, the process is straightforward and can be completed online through the IRS website. Other TINs may necessitate specific applications and documentation.

FAQs Regarding Tax Identification Numbers and Wholesale Purchases

1. Do I need a TIN to buy wholesale?

While not always mandatory, obtaining a TIN is highly recommended for businesses engaging in wholesale purchases. It facilitates smoother transactions, enhances trust with suppliers, and allows for accessing exclusive benefits.

2. What happens if I don’t have a TIN?

Without a TIN, certain wholesalers may decline to do business with you, hindering your access to wholesale pricing and availability. You may also face challenges in setting up business accounts and obtaining financing.

3. Can I use my personal SSN for wholesale purchases?

While possible for small businesses operating as sole proprietorships, using an SSN for wholesale purchases can expose your personal information and potentially complicate tax filings. It is generally recommended to obtain an EIN for business purposes.

4. How do I apply for an EIN?

An EIN can be applied for online through the IRS website. The process typically involves providing basic business information and completing a short application.

5. What are the penalties for not having a TIN?

Failing to obtain a TIN when required can result in penalties, including fines and potential legal repercussions. It is crucial to ensure compliance with tax regulations.

Tips for Utilizing a Tax Identification Number for Wholesale Purchases

- Obtain a TIN early: Apply for a TIN before beginning wholesale operations to ensure smooth transactions and access to benefits.

- Keep your TIN information secure: Protect your TIN from unauthorized access to prevent identity theft and fraudulent activities.

- Use your TIN consistently: Always provide your TIN when engaging in wholesale purchases, including order forms, invoices, and payment processing.

- Maintain accurate records: Keep detailed records of all wholesale transactions, including purchase orders, invoices, and payment receipts. This is crucial for tax compliance and financial management.

Conclusion: The Importance of Tax Identification Numbers in Wholesale Operations

Tax identification numbers are not mere bureaucratic requirements; they are essential tools for navigating the wholesale market effectively. By understanding the significance of TINs, businesses and individuals can establish legitimacy, streamline transactions, access exclusive benefits, and ensure compliance with tax regulations. Embracing the use of a TIN empowers you to unlock the full potential of wholesale purchasing, fostering growth and profitability in your endeavors.

:max_bytes(150000):strip_icc()/tax-indentification-number-tin.asp-30a92e7158164a03921914a81532f9ab.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Wholesale Market: Understanding the Importance of Tax Identification Numbers. We hope you find this article informative and beneficial. See you in our next article!