Navigating Financial Strain: Understanding and Utilizing Tax Installment Agreements

Related Articles: Navigating Financial Strain: Understanding and Utilizing Tax Installment Agreements

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Financial Strain: Understanding and Utilizing Tax Installment Agreements. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Financial Strain: Understanding and Utilizing Tax Installment Agreements

The complexities of the tax system often result in unexpected financial burdens for individuals and businesses. When faced with an inability to pay the full amount of taxes owed by the due date, the Internal Revenue Service (IRS) offers a crucial lifeline: the tax installment agreement. This arrangement allows taxpayers to pay their tax liability in manageable monthly installments, providing much-needed relief and preventing potentially devastating financial consequences.

Understanding the Foundation: What is a Tax Installment Agreement?

A tax installment agreement is a formal arrangement between the IRS and a taxpayer who cannot pay their tax liability in full by the due date. This agreement allows the taxpayer to pay their tax debt in monthly installments over an extended period, typically up to 72 months. The IRS generally requires taxpayers to demonstrate a genuine inability to pay their tax liability in full and to provide a detailed financial plan outlining their ability to make regular monthly payments.

Who Qualifies for a Tax Installment Agreement?

While the IRS offers this program as a valuable resource, eligibility is not automatic. Taxpayers must meet specific criteria to be considered for a tax installment agreement. These criteria typically include:

- Demonstrating a genuine inability to pay: The taxpayer must provide evidence of their financial hardship, such as significant debt, loss of income, or unexpected medical expenses.

- Maintaining a consistent payment history: The IRS assesses the taxpayer’s past payment history to gauge their reliability in making future payments.

- Meeting specific income requirements: The IRS may consider the taxpayer’s income level and other financial obligations to determine their ability to make regular monthly payments.

Types of Installment Agreements: Tailored Solutions for Diverse Needs

The IRS offers two main types of installment agreements, each tailored to different circumstances:

- Short-Term Installment Agreement: This option is available for taxpayers who owe less than $50,000 (including penalties and interest). This agreement allows for a shorter payment period, typically up to 180 days, and can be obtained online through the IRS website.

- Long-Term Installment Agreement: This agreement is available for taxpayers who owe more than $50,000 (including penalties and interest). It allows for a longer payment period, typically up to 72 months, and requires a formal application process, including providing detailed financial information.

The Application Process: A Step-by-Step Guide

Applying for a tax installment agreement involves several steps:

- Determine eligibility: Assess your financial situation and determine if you meet the eligibility criteria for a tax installment agreement.

- Gather necessary documentation: Compile relevant financial documents, such as bank statements, pay stubs, and tax returns, to support your application.

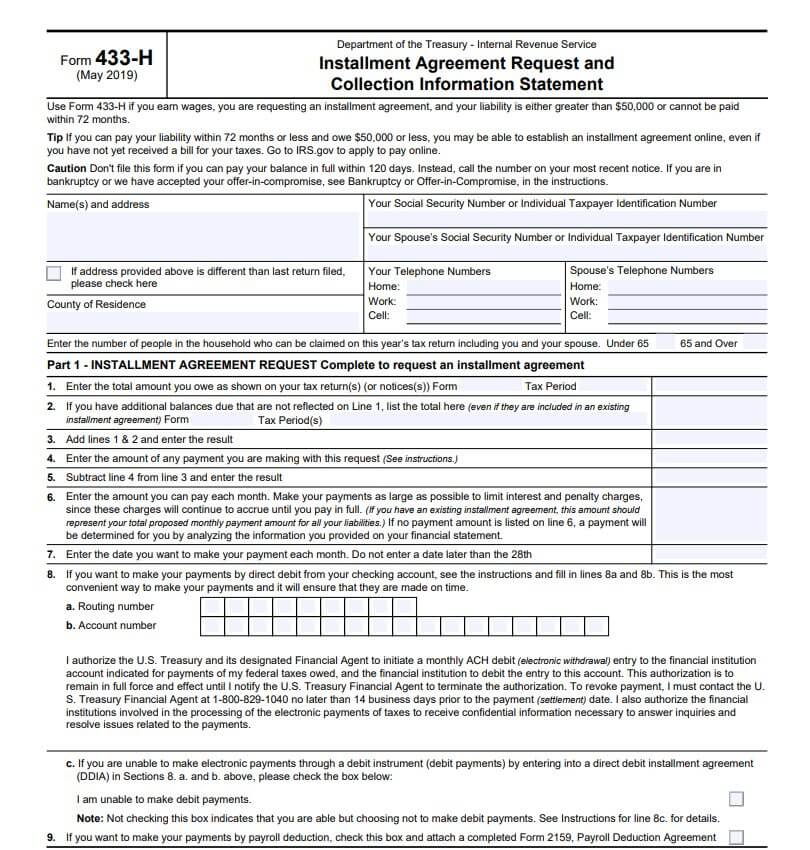

- Submit the application: Complete the necessary IRS forms (Form 9465 or Form 9465-A) and submit them along with supporting documentation.

- IRS review and approval: The IRS will review your application and supporting documents to determine your eligibility and approve or deny your request.

Benefits of a Tax Installment Agreement: A Financial Lifeline

Securing a tax installment agreement offers numerous benefits for taxpayers facing financial hardship:

- Avoid penalties and interest: Entering into an installment agreement helps prevent the accumulation of penalties and interest, which can significantly increase the total tax liability.

- Prevent wage garnishment or asset seizure: The IRS can take drastic measures like wage garnishment or asset seizure if taxes remain unpaid. An installment agreement prevents these actions and protects your financial stability.

- Maintain a good credit score: Unpaid taxes can negatively impact your credit score, making it difficult to secure loans or financing in the future. An installment agreement helps maintain a good credit score and protects your financial future.

- Peace of mind: Knowing that you have a structured payment plan in place provides peace of mind and reduces stress associated with managing a significant tax debt.

Potential Drawbacks: Understanding the Considerations

While a tax installment agreement offers significant relief, it’s essential to understand potential drawbacks:

- Interest and penalties: The IRS charges interest and penalties on unpaid tax liabilities, even if you are making installment payments.

- Fees: The IRS charges a user fee for entering into a tax installment agreement, which can range from $10 to $225, depending on the agreement type.

- Potential for denial: The IRS may deny your request for an installment agreement if you fail to meet eligibility criteria or if they deem your financial plan insufficient.

FAQs: Addressing Common Questions

Q1: How do I apply for a tax installment agreement?

A: You can apply online through the IRS website, by mail, or by phone. The specific forms and instructions will vary depending on the type of installment agreement you are seeking.

Q2: How long does it take to process an installment agreement application?

A: The processing time for an installment agreement application can vary depending on the complexity of the case and the volume of applications received by the IRS. It can take several weeks or even months to receive a decision.

Q3: What happens if I miss a payment on my installment agreement?

A: Missing a payment can result in penalties and interest charges. The IRS may also revoke your installment agreement and require you to pay the full balance immediately.

Q4: Can I get an installment agreement for a tax lien?

A: Yes, you can request an installment agreement to pay off a tax lien. However, the IRS may require you to secure a payment bond or other security measures to ensure payment.

Q5: Can I negotiate the terms of my installment agreement?

A: While the IRS sets the general terms of installment agreements, you can negotiate certain aspects, such as the payment amount or the payment period, depending on your specific circumstances.

Tips for Success: Maximizing Your Chances of Approval

To increase your chances of securing a tax installment agreement, consider these tips:

- Act promptly: Don’t wait until the last minute to apply for an installment agreement. The sooner you apply, the more time you have to address any issues or concerns raised by the IRS.

- Be transparent and honest: Provide accurate and complete information on your application and supporting documents.

- Demonstrate your commitment: Show the IRS that you are committed to paying off your tax liability by providing a detailed financial plan and outlining your ability to make regular payments.

- Seek professional advice: If you are struggling to understand the tax installment agreement process or if you have complex financial circumstances, consider seeking professional tax advice from a qualified tax professional.

Conclusion: A Path to Financial Stability

A tax installment agreement can be a valuable tool for taxpayers facing financial hardship. It provides a structured payment plan that allows individuals and businesses to manage their tax debt and avoid potentially devastating financial consequences. By understanding the eligibility criteria, application process, and potential drawbacks, taxpayers can make informed decisions and maximize their chances of securing this critical financial lifeline.

Closure

Thus, we hope this article has provided valuable insights into Navigating Financial Strain: Understanding and Utilizing Tax Installment Agreements. We hope you find this article informative and beneficial. See you in our next article!